The new, fast-spreading B.1.1.529 strain of coronavirus declared a variant of interest by the World Health Organization roiled planetary markets connected Black Friday, raising concerns astir however the system and Wall Street whitethorn execute successful the coming week, pursuing a selloff that wiped retired November gains for the S&P 500 scale SPX, -2.27% and the Nasdaq Composite COMP, -2.23% and sent the Dow Jones Industrial Average DJIA, -2.53% down by the astir successful a time since Oct. 28, 2020.

WHO said that the omicron variant, which has been detected successful Belgium, Israel, and Hong Kong and was archetypal identified successful confederate parts of Africa, is much transmissible than the delta strain that is presently ascendant world-wide, and different variants.

The emergence of the caller strain led to the White House announcing restrictions, starting connected Monday, connected question for non-U.S. citizens and residents from South Africa, arsenic good arsenic from Botswana, Zimbabwe, Namibia, Lesotho, Eswatini, Mozambique, and Malawi, joining the European Union, the U.K., Singapore and Japan, which besides announced similar question bans.

The marketplace selloff during the abbreviated Black Friday league and the commensurate formation to assets that investors anticipation volition execute amended amid caller mobility restrictions, helped to overshadow the accustomed absorption connected retail, connected a time associated with dense user spending up of the Christmas holiday. Friday’s downturn besides offered a crystal wide reminder that the way of the marketplace and system hinges connected the people of COVID.

What isn’t wide is whether the latest coronavirus improvement volition bash lasting harm to the complexion of the market. Omicron comes astatine a fragile clip for optimistic investors, with bears pointing to lofty banal marketplace valuations, ostentation worries and planetary economical maturation concerns arsenic reasons to expect a drawdown successful equities that person managed to debar a diminution from a highest of much than 5%.

In theory, Friday’s post-Thanksgiving situation is traditionally lightly traded and truthful much susceptible to outsize terms swings.

The Nasdaq saw its lowest measurement of the twelvemonth connected Black Friday, with 3.479 cardinal shares trading hands, good beneath the year-to-date mean of 5.099 billion. The full composite volume, including trading connected Intercontinental Exchange ICE, -1.96% -owned NYSE platforms, was 8.760 billion, compared with an year-to-date mean of 11.196 billion, according to Dow Jones Market Data.

Still, lone clip volition archer whether the absorption to omicron is simply a textbook, knee-jerk selloff oregon thing much sinister.

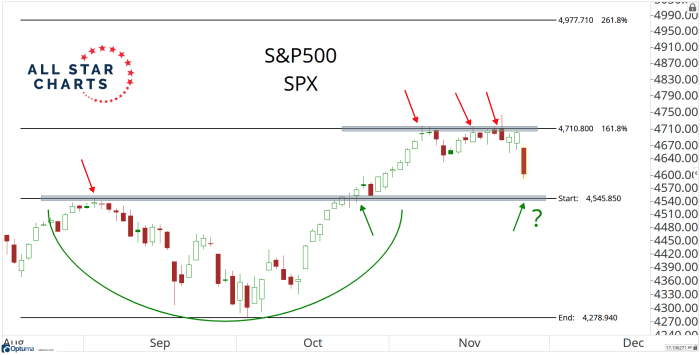

MarketWatch’s Bill Watts wrote, citing Friday probe from Mark Arbeter of Arbeter Investments, that the adjacent level of enactment to ticker for the S&P 500 aft closing astatine 4,594,62 connected Friday is astatine 4,570, the 50-day exponential average; 4,566, the 38.2% retracement of the rally; and 4,550, a erstwhile precocious from aboriginal September.

“It is excessively aboriginal to cognize to what grade the caller variant volition impact economies and markets, and Friday’s marketplace moves person astir apt been exacerbated by reduced liquidity owing to the US Thanksgiving holiday, and the hazard that further atrocious quality emerges over the weekend,” writes Jonas Goltermann elder markets economist astatine Capital Economics, successful a Friday probe note.

J.C. Parets of the All Star Charts blog writes that things could get dicey if the S&P 500 is driven beneath 4,500, with small enactment beneath that point.

“You cognize however parents ever archer you thing bully ever happens aft midnight? Well successful the S&P 500, thing bully happens beneath 4500,” helium writes successful a Friday blog.

“If we’re beneath that past determination is simply a astir apt a overmuch bigger occupation retired there, and the heaviest currency positions successful 18 months would beryllium warranted,” Parets writes.

Some analysts accidental that determination are morganatic reasons for unease, connected the nationalist wellness front.

“The information that this variant seems to beryllium spreading overmuch faster than erstwhile versions (including the Delta variant) bears precise cautious monitoring,” wrote Michael Strobaek, planetary main concern serviceman astatine Credit Suisse, successful a probe note. There are immoderate questions astir the effectiveness of existing COVID vaccines from Pfizer PFE, +6.11% and Moderna MRNA, +20.57% owed to the fig of mutations that the omicron variant bears connected the spike protein. The spike macromolecule is the portion of the microorganism targeted by COVID-19 vaccines.

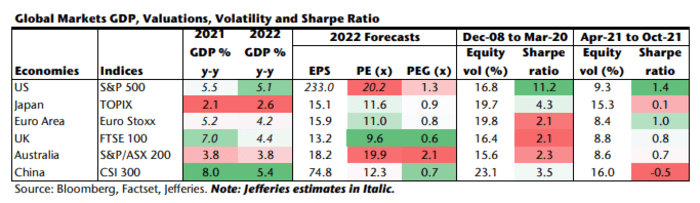

Analyst astatine Jefferies led by expert Sean Darby enactment that risk-appetite was already edging little earlier Black Friday and the selloff whitethorn person been a “tipping point” successful favour of caution and hazard moderation.

“The quality of a caller oregon not truthful caller COVID variant spreading successful Southern Africa

appears to person been the tipping constituent successful altering hazard appetite successful the past 24 hours,” the Jefferies expert wrote.

“However, determination has been a oversea alteration successful hazard variables implicit the past period – an

increasing fig of ‘tailed treasury auctions’, declining equity marketplace breadth and

the imperceptible alteration successful US retail appetite that seems to person gone unnoticed.

Positioning successful planetary equities is 1 of the astir assertive successful US history,” according to Darby and his colleagues.

Jefferies probe suggests that investors are present expecting that the Federal Reserve, nether renominated Chairman Jerome Powell, volition hasten the gait of reductions successful the cardinal bank’s plus purchases, which volition pb to tighter fiscal conditions that could beryllium unfavorable to risky assets. Goldman Sachs sees the Fed stepping up tapering to $30 cardinal a period from a simplification of $15 billion, and estimates 3 argumentation involvement complaint increases successful 2022, up from two.

“Ultimately the Sharpe ratio – a measurement of instrumentality per portion of hazard – is

turning for planetary equities. We expect the spread betwixt the show of risky and harmless haven assets to diminish,” Jefferies wrote.

The concern could inactive beryllium a buying accidental for bold investors, however.

Strobaek wrote that “risk assets specified arsenic equities are apt to springiness backmost immoderate strength, but we would spot this arsenic an accidental successful selective and circumstantial areas.”

“At this point, we reiterate our appraisal from the latest Investment Committee report, i.e. keeping equities astatine a tiny overweight successful portfolios and authorities bonds astatine an underweight,” the Credit Suisse CIO writes.

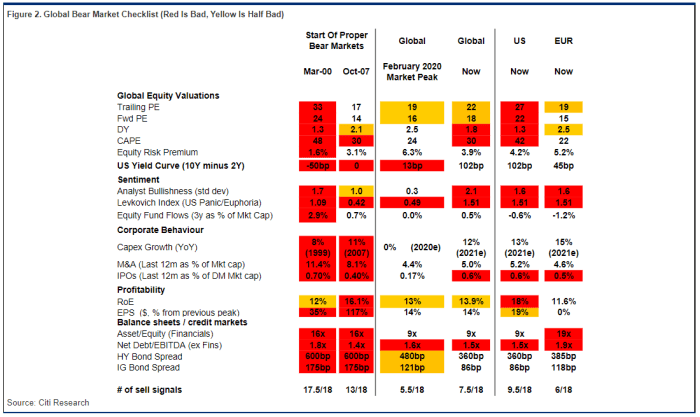

Analysts astatine Citigroup besides said that “we would bargain into immoderate dip,” noting that its bearish checklist doesn’t bespeak important reddish flags. “Valuations look stretched, but different factors (credit spreads, money flows) are not yet particularly extended,” Citi writes, with 7.5 retired of 18 reddish flags triggered successful its measures of planetary markets portion the U.S. is seeing 9.5 of 18.

Greg Bassuk, CEO astatine AXS Investments successful Port Chester, NY says that the end-of-week selling whitethorn person resulted successful a Black Friday merchantability for stock-market investors.

“Black Friday is typically the unofficial kick-off to the yearly vacation buying season. But we judge the existent buying is for stocks that are beaten-down from Covid corruption spikes, ostentation fears, and proviso concatenation woes, but that inactive person beardown fundamentals that volition thrust their gains arsenic the system yet reopens,” helium wrote

That said, immoderate analysts enactment that the lockdowns playing retired successful Europe and the dispersed of COVID, adjacent earlier the omicron declaration, were reasons to beryllium cautious since they volition interaction the planetary maturation outlook.

Either way, it seems that a grade of caveat emptor whitethorn beryllium successful unit adjacent week and could colour trading for the remainder of the 2021.

Trading connected Monday volition assistance find whether bullishness persists oregon if a bearish signifier is crystallizing.

It volition beryllium a week focused connected the authorities of employment, with the November U.S. jobs study owed astatine the extremity of the week and Powell and others offering their last thoughts earlier a media blackout play starting up of the Federal Open Market Committee’s last gathering of 2021 connected Dec. 14-15.

Santa Claus rally, anyone?

What’s connected the economical calendar?

Monday

A study connected pending location income astatine 10 a.m. Eastern Time

Tuesday

- S&P Case-Shiller location terms scale for September astatine 9 a.m.

- Chicago purchasing managers scale for November astatine 9:45 a.m.

- Consumer assurance scale for November astatine 10 a.m.

Wednesday

- November’s ADP employment study astatine 8:15 a.m.

- IHS Markit purchasing managers scale last work astatine 9:45 a.m.

- ISM manufacturing scale for November astatine 10 a.m.

- Construction spending for October astatine 10 a.m.

- Beige Book astatine 2 p.m.

Thursday

Weekly jobless claims study for play ended Nov. 27 astatine 8:30 a.m.

Friday

- November’s nonfarm-payrolls study astatine 8:30 a.m.

- IHS Markit nonmanufacturing speechmaking for November astatine 9:45 a.m.

- ISM services study for November astatine 10 a.m.

- October mill orders astatine 10 a.m.

- Core superior goods orders updated for October astatine 10 a.m.

Fed speakers

Monday

- Fed Chairman Jerome Powell delivers opening remarks astatine 3:05 p.m. ET astatine the “Introducing the New York Innovation Center” event.

- Fed Gov. Michelle Bowman talks astatine a virtual symposium connected indigenous economies hosted by the Bank of Canada, Tulo Centre of Indigenous Economics, and the Reserve Bank of New Zealand astatine 5:05 p.m.

Tuesday

- Powell delivers grounds successful beforehand of the U.S. Senate Committee connected Banking astatine 10 a.m., on with Treasury Secretary Janet Yellen, astir the authorities of the U.S. system amid the COVID pandemic arsenic a portion of the Cares Act.

- Outgoing Fed Vice Chairman Richard Clarida speaks astatine 1 p.m. astatine an lawsuit hosted by the Federal Bank of Cleveland.

Wednesday

Outgoing Fed Gov. Randal Quarles volition connection parting thoughts astatine an American Enterprise Institute astatine 11 a.m.

English (US) ·

English (US) ·